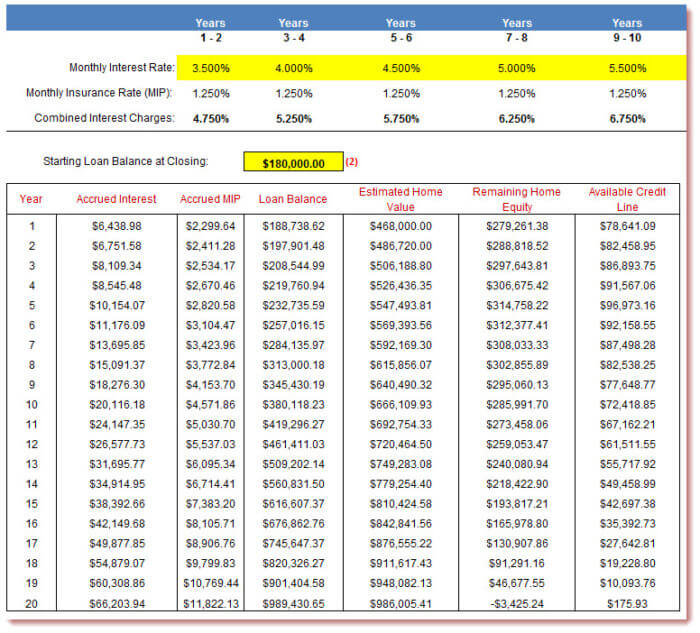

Nonetheless, assuming a mortgage agreement allows for faster repayment, a borrower can employ the following techniques to reduce mortgage balances more quickly and save money: Thus, a borrower may first need to check with the lending bank to see if utilizing such strategies is allowed. Moreover, some loan contracts may not explicitly permit some loan reduction techniques. The amortization table shows how a loan can concentrate the larger interest payments towards the beginning of the loan, increasing a bank's revenue. However, lengthier loans help to boost the profit of the lending banks. In many situations, a borrower may want to pay off a mortgage earlier to save on interest, gain freedom from debt, or other reasons. Amortizing a Mortgage Faster and Saving Money The calculator can also estimate other costs associated with homeownership, giving the borrower a more accurate financial picture of the costs associated with owning a home. For example, a bank would amortize a five-year, $20,000 loan at a 5% interest rate into payments of $377.42 per month for five years. The amortization table below illustrates this process, calculating the fixed monthly payback amount and providing an annual or monthly amortization schedule of the loan. As the borrower approaches the end of the loan term, the bank will apply nearly all of the payment to reducing principal. In other words, the interest portion of each payment will decrease as the loan's remaining principal balance falls. Over time, the balance of the loan falls as the principal repayment gradually increases. The principal is the portion of the payment devoted to paying down the loan balance. Interest is the fee for borrowing the money, usually a percentage of the outstanding loan balance. Each payment is composed of two parts, interest and principal. In most cases, the amortized payments are fixed monthly payments spread evenly throughout the loan term. Nonetheless, our mortgage amortization calculator is specially designed for home mortgage loans.

#WELLS FARGO AMORTIZATION CALCULATOR SERIES#

Using this technique, the loan balance will fall with each payment, and the borrower will pay off the balance after completing the series of scheduled payments.īanks amortize many consumer-facing loans such as home mortgage loans, auto loans, and personal loans. In the context of a loan, amortization is a way of spreading the loan into a series of payments over a period of time.

0 kommentar(er)

0 kommentar(er)